January 9, 2026

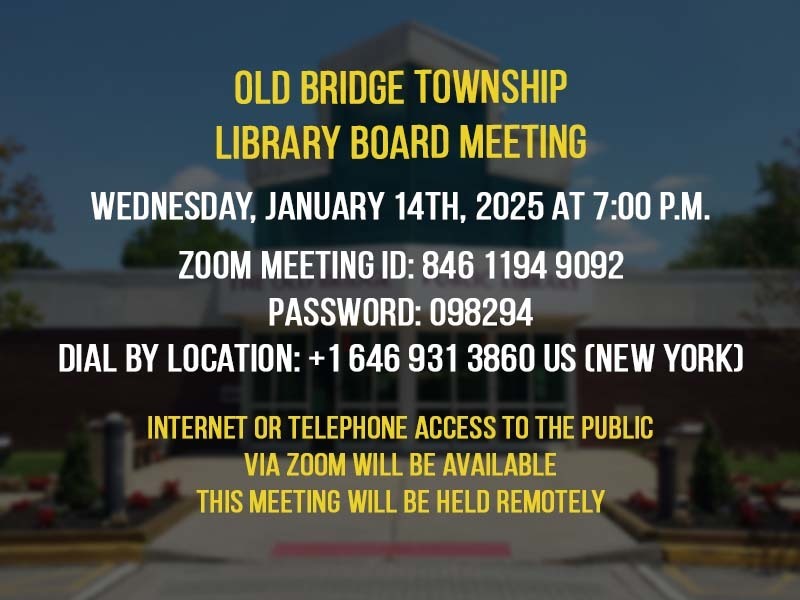

The Old Bridge Public Library Board of Trustees will hold its regular monthly meeting on Wednesday, January 14, 2026 at 7:00 p.m. The meeting will be held at the Central Library, ...

January 6, 2026

Township of Old Bridge Old Bridge Township Open Space Committee Re-Organizational Meeting January 7, 2026-CANCELLATION And Reschedule to Wednesday January 21, 2026 TAKE N...

January 5, 2026

Township of Old Bridge Old Bridge Township Ethics Board Re-Organizational Meeting January 8, 2026 TAKE NOTICE that the annual Re-Organizational meeting of the Old Bridge ...

January 5, 2026

Township of Old Bridge Old Bridge Township Environmental Re-Organizational Meeting January 7, 2026 TAKE NOTICE that the annual Re-Organizational meeting of the Old Bridge En...

January 5, 2026

Township of Old Bridge Old Bridge Township Open Space Committee Re-Organizational Meeting January 7, 2026 TAKE NOTICE that the annual Re-Organizational meeting of the Old...

January 2, 2026

The Old Bridge Township Council 2026 Meeting Schedule Tuesday, January 13th, 2026 Tuesday, January 27th, 2026 Tuesday, February 3rd, 2026 Tuesday, February 24th, 2026 Tuesd...

January 2, 2026

Library Board of Trustees 2026 Meeting Schedule Time: 7:00 p.m. January 14, 2026 February 11, 2026 March 11, 2026 April 8, 2026 May 13, 2026 June 10, 2026 July 8, 2026 ...

January 2, 2026

Temporary Staff Librarian – Adult Services Full-Time for Approximately Three Months (February – April 2026): $36.53 per hour/35 hours per week Organizational Role Provi...

January 2, 2026

Library Assistant, Digital Support Services Part-time: $19.91 per hour The Old Bridge library is seeking a part-time Library Assistant to work at our Digital Support Servic...

December 23, 2025

Township of Old Bridge Township Council Re-Organizational Meeting January 1, 2026 TAKE NOTICE that the annual Re-Organizational meeting of the Township Council of the Towns...

December 23, 2025

TOWNSHIP OF OLD BRIDGE MIDDLESEX COUNTY, NEW JERSEY PUBLIC NOTICE NOTICE OF SPECIAL MEETING Notice is hereby given that the Township Council of the Township of Old Bri...

December 8, 2025

Please be advised that there will be some drilling work being done by the EPA at the Laurence Harbor beachfront starting Monday (December 8 th ). The schedule is as follows...

December 5, 2025

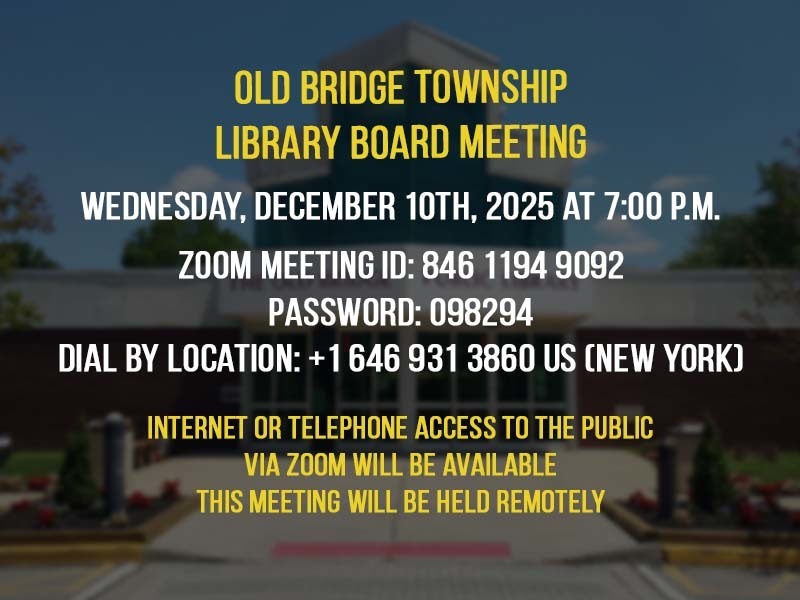

The Old Bridge Public Library Board of Trustees will hold its regular monthly meeting on Wednesday, December 10, 2025 at 7:00 p.m. The meeting will be held at the Central Library,...

December 2, 2025

TONIGHT, DEC 2, 2025 Rent Stabilization Board Meeting is Canceled. Next meeting will be on January 6, 2026.

November 21, 2025

Position Description: Facility Manager, Full Time Reports to: Library Director Job Description: Under the direction of the Library Director and with the assistance of con...

November 19, 2025

PLEASE TAKE NOTICE that the originally scheduled meeting of the Old Bridge Township Shade Tree Commission of November 19, 2025 has been cancelled. The next meeting is scheduled f...

November 18, 2025

Schedule: Wednesday November 19, 2025, to Friday November 21, 2025 Milling & Paving: Bayview Drive (Jefferson Avenue to Harding Road) Harding Road (Bayview Drive to G...

November 14, 2025

Old Bridge Township Planning Board 2026 Meeting Schedule Thursday, January 29, 2026 Re-Organization & Regular Meeting 7:30 pm Thursday, February 26, 2026 Regular Meeting 7:30...

November 14, 2025

Part-Time Staff Librarian – Adult Services (24 hours per week) $35.55 per hour/24 hours per week. Organizational Role Provides reference and reader’s advisory services. ...

November 14, 2025

Location: See Below: Milling & Paving Eisenhower Drive Carter Drive to Reagan Street Milling & Paving Cedar Avenue Milling & Paving Hartle ...