February 24, 2026

As you know, our community experienced a historic blizzard, with significant snowfall totals and dangerous wind conditions. During the height of the storm, we had extreme weather ...

February 20, 2026

Executive Assistant for Finance The Old Bridge Public Library seeks an enthusiastic, detailed-oriented Executive Assistant to join our Administrative team. The successful cand...

February 19, 2026

Please be advised that the Old Bridge Township Zoning Board Meeting scheduled for February 19th, 2026, has been Canceled.

February 18, 2026

PLEASE TAKE NOTICE that the originally scheduled meeting of the Old Bridge Township Shade Tree Commission of February 25, 2026 at 6:00 pm, located at 1 Old Bridge Plaza, Old Bridg...

February 11, 2026

Please be advised that the Old Bridge Township Zoning Board Meeting scheduled for March 5, 2026, has been Canceled.

February 6, 2026

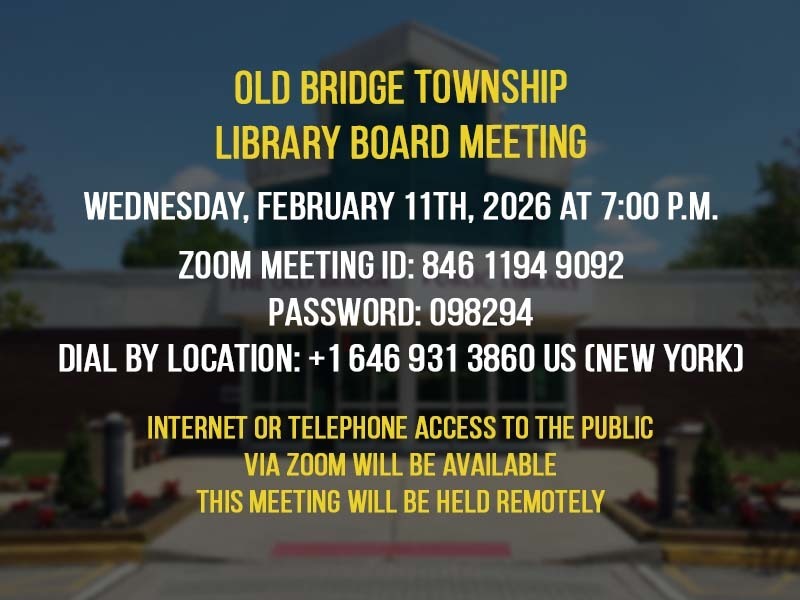

The Old Bridge Public Library Board of Trustees will hold its regular monthly meeting on Wednesday, February 11, 2026 at 7:00 p.m. The meeting will be held at the Central Library,...

February 5, 2026

PURPOSE: The Township of Old Bridge is seeking funding through the State of NJ Green Acres Program for improvements at Ticetown Road Park located at 526 Ticetown Road, Old Bridge...

February 2, 2026

The February 3, 2026, Rent Stabilization Board meeting is Canceled. The Board will reconvene in March 3,2026.

January 29, 2026

The storm caused widespread blood drive cancellations and donor center closings, resulting in a loss of an additional 2,000 blood donations to an already fragile blood supply. T...

January 29, 2026

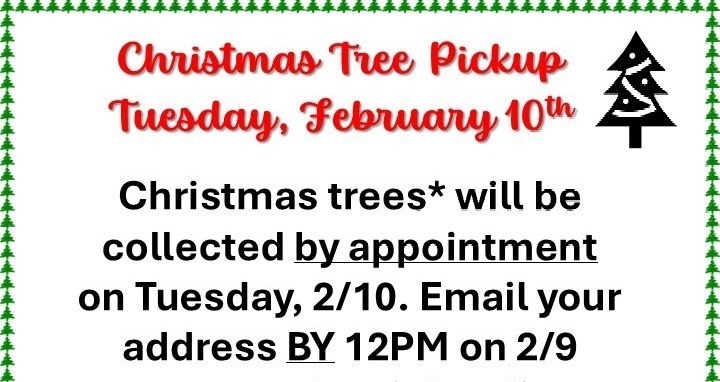

Real Christmas trees will be picked up on Tuesday 2/10/2026, by appointment only. Email your address to recycling@oldbridge.com by 12PM on 2/9/2026, to get on the list. Place und...

January 28, 2026

The Old Bridge Redevelopment Agency meeting originally scheduled for February 26, 2026, has been canceled and rescheduled for February 11, 2026, in Room 201 in the Municipal Co...

January 27, 2026

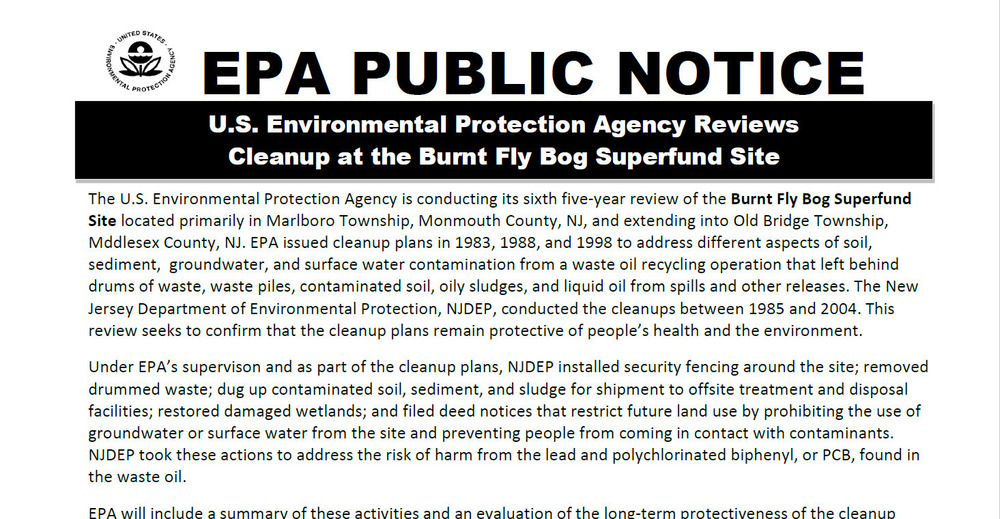

To read the complete EPA public notice regarding the sixth, five-year review of the Burnt Fly Bog Superfund Site, please click here .

January 27, 2026

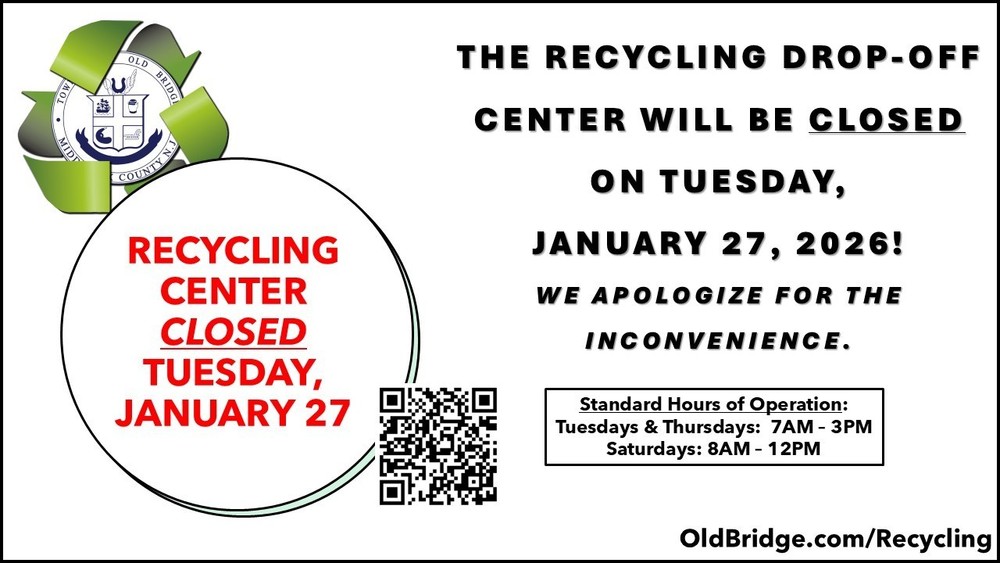

The Old Bridge Recycling Drop Off Center will be Closed on Tuesday, January 27, 2026. We apologize for any inconvenience this may cause. For updates, please visit www.oldbridge.co...

January 26, 2026

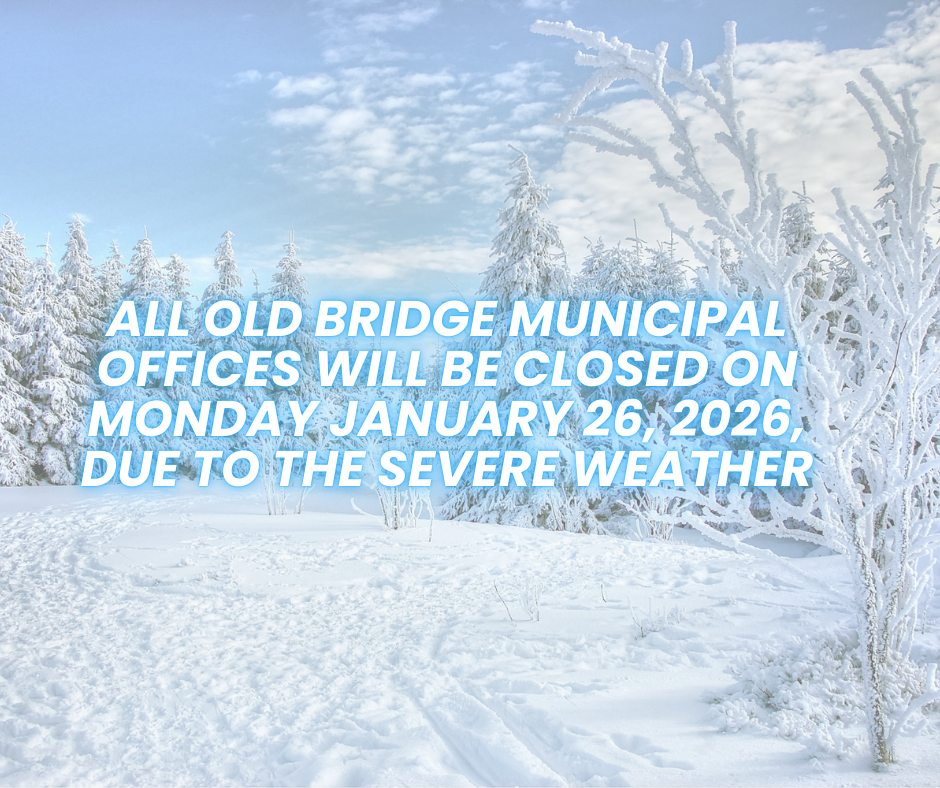

Storm update: All Old Bridge Municipal Offices will be closed on Monday January 26, 2026, due to the severe weather. The Senior Center will also be closed, and all recreation acti...

January 26, 2026

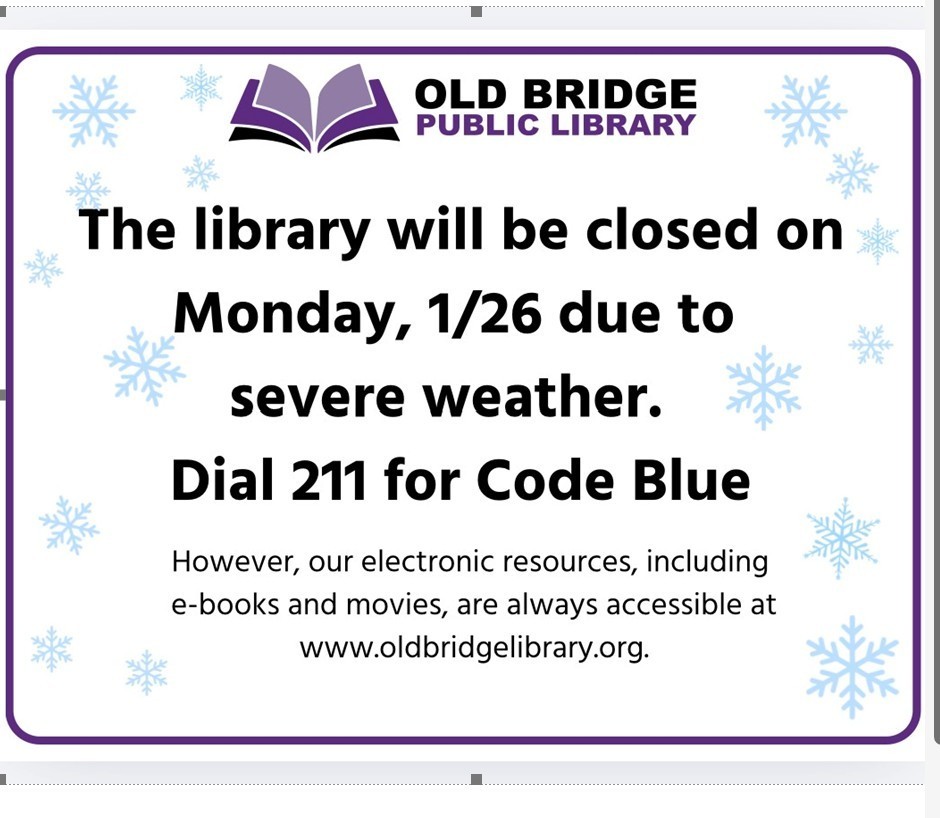

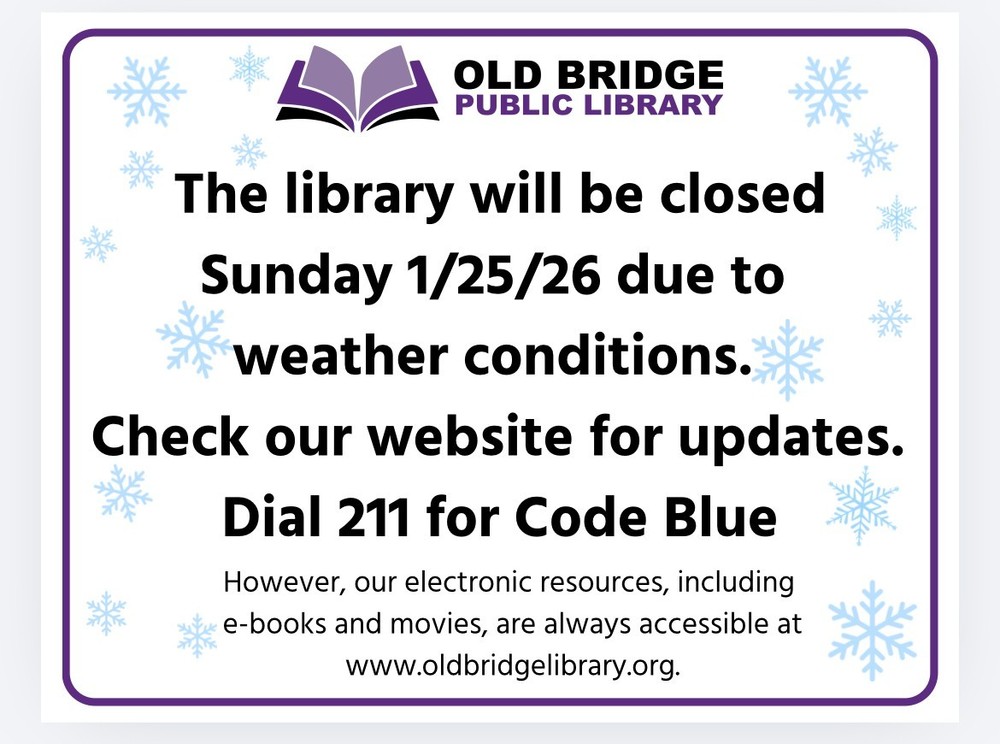

The Old Bridge Library will be closed on Monday January 26, 2026, due to the severe weather. For updates and electronic resources, please visit www.oldbridgelibrary.org . Dial 2...

January 24, 2026

The Old Bridge Library will be closed on Sunday 1/25/2026. For updates on the library's hours please visit their website www.oldbridgelibrary.org. Dial 211 for Code Blue.

January 21, 2026

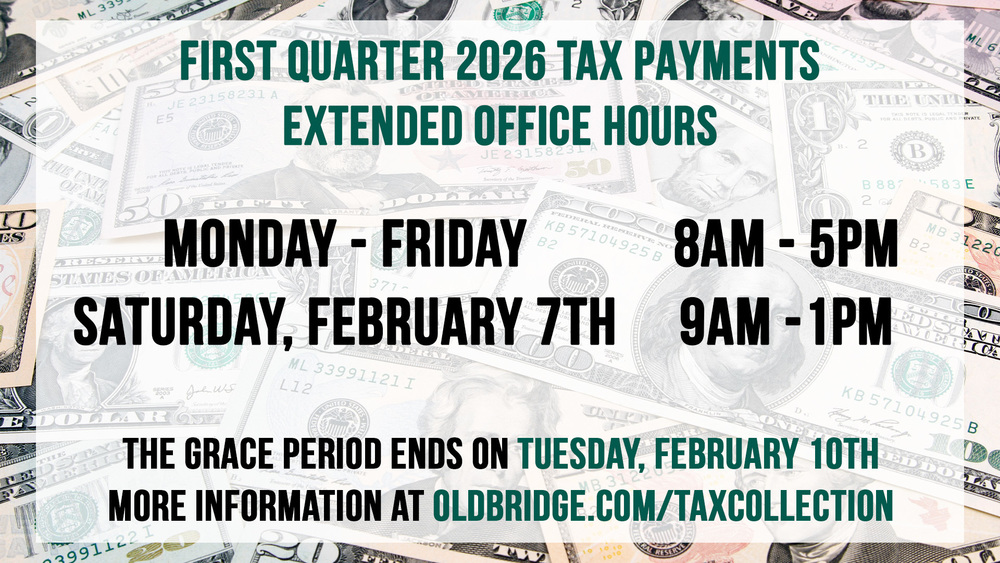

The Tax Collector’s Office will be open during the 1st Quarter 2026 collection period Monday through Friday - 8 AM to 5 PM Additionally, Saturday, February 7th - 9 AM to 1 PM T...

January 17, 2026

Old Bridge Township Open Space Committee Re-Organizational Meeting of January 21, 2026, has been CANCELED And Rescheduled to Wednesday February 4, 2026, at 7:00pm. TAKE NOTICE tha...

January 16, 2026

Mayor Walker visited the John Piccolo Ice Arena on Wednesday, January 14 th for Operation Beachhead. Founded in 2011, Operation Beachhead is a unique 501(c)(3) non-profit organi...

January 9, 2026

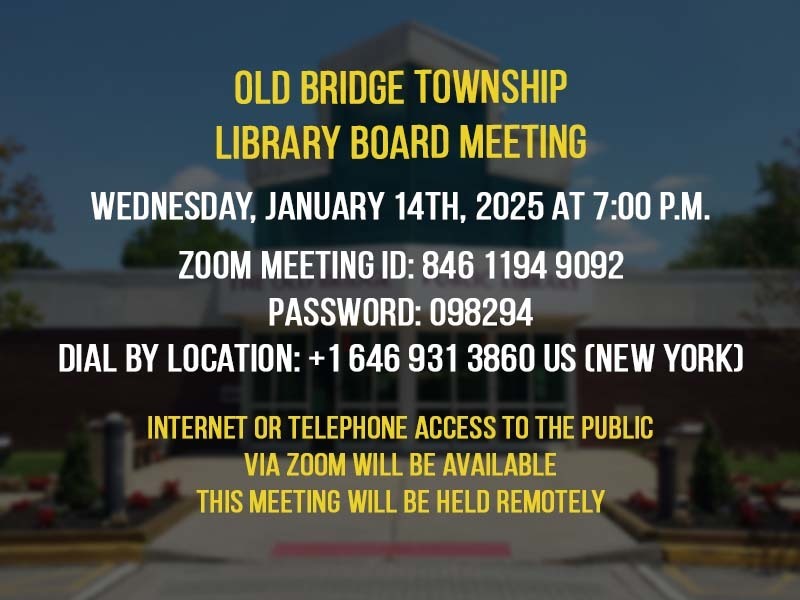

The Old Bridge Public Library Board of Trustees will hold its regular monthly meeting on Wednesday, January 14, 2026 at 7:00 p.m. The meeting will be held at the Central Library, ...